Send a check to JAARS, PO Box 248, Waxhaw, NC 28173.

Please include the following:

- The area(s) you’d like to designate your gift toward, if any

- Your mailing address, if you’d like a receipt for tax purposes

- Your phone number and/or email address, so that we may contact you with any questions

Appreciated Securities

Pay less in taxes, and put more toward making Bible translation possible. It’s easy: If you’ve owned assets such as stocks, bonds, or mutual funds for more than a year, and they’ve increased in value, sign them over to JAARS. You’ll get the usual income deduction—if you qualify—and skip capital gains taxes. Learn more below, or you can email us or call 888.773.1178 to get started.

Qualified Charitable Distributions—A Tax-Free Option

If you are 70½ or older, you can give to JAARS directly from your IRA account—without having to pay any income taxes on the transfer. QCDs, also known as IRA rollovers, must be received by December 31 to qualify for this calendar year. To get started, follow the simple steps below.

How do I take advantage of this strategy?

1. Contact your IRA administrator to initiate the transfer. Please note, the gift must come directly from your IRA account to qualify.

2. Checks should be made out to our parent organization, SIL International, with the memo: “For the preferred use of JAARS.”

3. Checks should be mailed to JAARS, PO Box 248, Waxhaw, NC 28173. Please include a letter stating that this is an IRA rollover, and note if you would like to designate your gift to a specific fund.

What are the benefits?

- Pay no taxes on transfers of up to $100,000 to a qualifying charity.

- Reduce your taxable income, even if you don’t itemize deductions.

- Count the gift toward your required minimum distribution for the year.

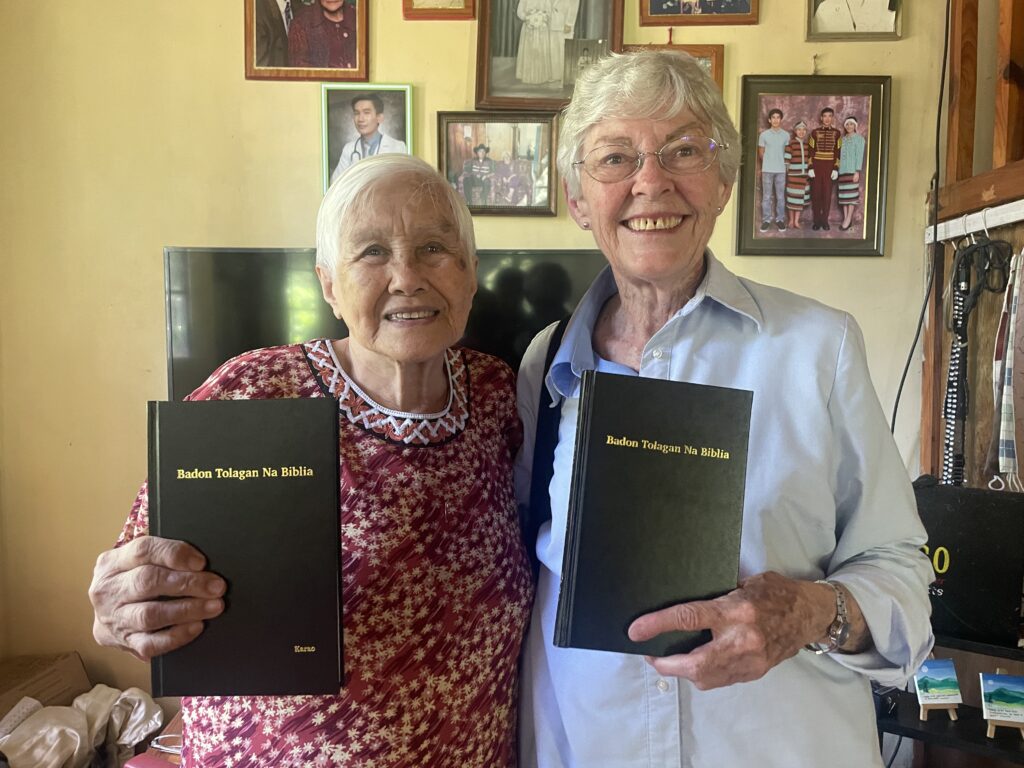

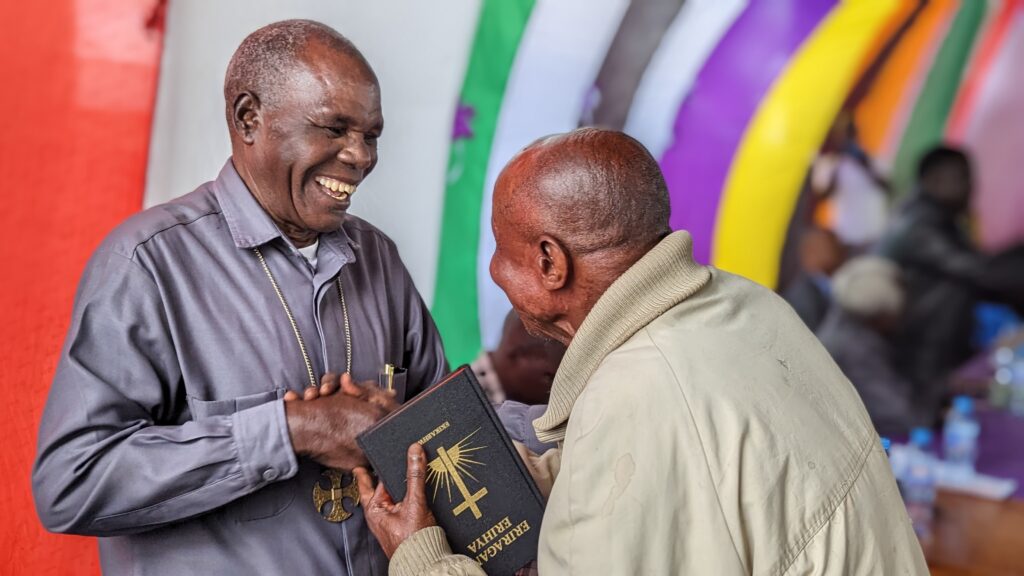

Planned Giving

Leave a legacy that helps cover the last mile of missions and makes Bible translation, church planting, Scripture engagement, and more possible.

To name JAARS as a beneficiary of your will, estate plan, donor advised funds, IRA rollover, 401k distribution, appreciated securities, gifts in kind, and more, please use the following language on your documents:

“______ (the % or $ amount you’d like to give) of ______ (the name of the underlying asset or assets) to JAARS, Inc., PO Box 248, Waxhaw, NC 28173, Federal Tax ID #56-0818833.”

Email us or call 888.773.1178 with any questions. We’re glad to discuss your vision and help you plan for a lasting impact.

Goods or Property

We’re always looking for small aircraft, vehicles, and boats. Sometimes, they can be outfitted and sent to our partners. Other times, we’ll sell the item and put that money toward the most pressing needs.

We can’t accept computers or clothes. But we can take plenty of other things, such as artwork, fine jewelry, collectibles, or real estate. Email us or call 888.773.1178 to get started. We’ll be glad to discuss your unique situation!

Workplace Giving

Does your company let you give through payroll deductions? Or a yearly campaign? See if JAARS is an option. It adds up, especially if your company matches gifts.