CARES Act Charitable Donation Provisions

Did you know?

- If you itemize deductions on your federal taxes, you can deduct up to 100% of your AGI for charitable gifts made in 2021, and carry over any excess for 5 years.

- Even if you don’t itemize, you can deduct up to $300, or $600 if married filing jointly.

- If you are at least 59½, you may take a distribution of any amount from your IRA or 401k, give the same amount to a qualified charity, and avoid paying any federal income taxes on the distribution.

These provisions and more are included in the CARES Act passed by congress in hopes that it will stimulate charitable giving during the pandemic. However, you must act by December 31, 2021, to take advantage of these temporary changes.

What does this mean for you?

- If you fill out Schedule A on your federal income tax return, you may now deduct up to 100% of your AGI for gifts made to qualified charities. This deduction allowance is an increase from 60% of AGI in previous years.

- Qualified charities include public charities and churches, but do not include private foundations, supporting organizations, or donor advised funds, commonly called giving funds.

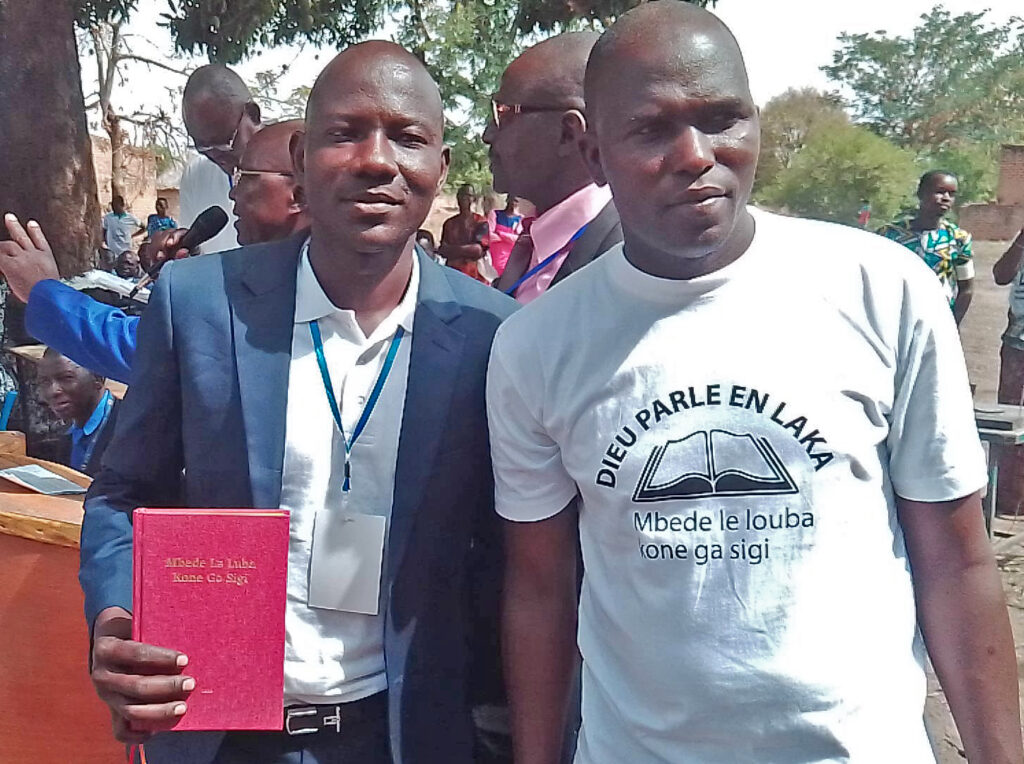

- Because JAARS is a “supporting organization” to SIL International (for IRS purposes), checks and/or gift designations should be made out to “SIL International” and noted “For the preferred use of JAARS.”

- If you do not fill out schedule A on your federal income tax forms, you can still get a deduction as if you did for gifts totaling up to $300 to qualified charities, or $600 if married filing jointly (see above).

Should you decide to give more than 100% of your AGI in 2021, you may carry forward the deduction for up to five years.

If you are at least 70½ years old, you already had the benefit of making an IRA charitable rollover contribution up to $100,000 as a satisfaction of your required minimum distribution. That rule was not changed by the CARES Act.

But if you are between 59½ and 70½, the CARES Act allows you take a distribution from your IRA or 401k, contribute the same amount to a qualified charity, and take a deduction of 100% of the gift on your federal taxes. An IRA or 401k distribution is taxed as ordinary income. So, if you take a distribution of $50,000, that could put you in a higher income tax bracket and significantly increase your federal tax. But if you give the $50,000 to one or more qualified charities, you can take a deduction of 100% of it, preventing a higher tax bracket and totally offsetting taxes on the distribution.

Corporations are also being encouraged to give by the CARES Act. Corporations can now deduct up to 25% of their taxable income for gifts made to qualified charities in 2021, an increase from 10%.

Several important things to keep in mind when making your giving decisions:

- The CARES Act provisions apply only to federal taxes. Most states have not changed their rules regarding charitable contributions. Therefore, your deduction allowance for a charitable gift will be a lower percentage and you may owe state income tax on any IRA or 401k distribution.

- Remember that there is a difference between a tax credit and a tax deduction. A tax credit directly reduces the tax you owe. A tax deduction reduces the amount of income that is taxed. The CARES Act provisions have to do with deductions, not credits.

- This summary refers to cash gifts only. The CARES Act does not change the rules for making non-cash gifts, such as stock, real estate, or other property.

- Every situation is different. For example, you may not be able to take advantage of the CARES Act provisions because of the Alternative Minimum Tax (AMT) and other income tax regulations. Always check with your tax advisor before making a large gift.

- Finally, the CARES Act applies only to 2020 and 2021 charitable gifts. These provisions will likely not be extended.

To learn more, check with your tax adviser. This educational illustration is not professional tax or legal advice.